palm beach county business tax receipt appointment

APPLICATION FOR PALM BEACH LOCAL. Return the original form to the Tax Collectors Office to obtain a Business Tax Receipt for Palm Beach County.

PBCFR - Business Tax Receipt BTR Inspection.

. Palm Beach County Tax Collector. Renew online or by. Please attach a copy of your current palm beach county local business tax receipt.

Attention Contractors When you apply for your permit. Local Business Tax Receipts expire annually on September 30 and may be renewed on or after July 1. 4 palm beach county local business tax receipt formerly occupational license.

Failure to have a current. The local County Tax. West Palm Beach FL 33402-3353.

Please note that any business that opens or begins operating prior to obtaining an approved business tax receipt will be charged an. Business Tax Receipts Village of Royal Palm Beach Florida Business Tax Receipts Business Tax Receipts Mission Statement To provide a high level of customer service and support to. Completed Palm Beach County Business Tax Receipt Application Do not go to the county tax collectors office until have received Zoning approval from the Village of North Palm Beach.

If your business is based within Palm Beach County you must provide a Palm Beach County Wide Business Tax Receipt. Renewal notices are mailed to the current mailing address of record. A copy stays with the Village of Royal Palm Beach.

Town of Palm Beach. A COU is issued with a Business Tax Receipt. Burkhart Today To Assist With All OF Your Local And County Tax Receipt Questions And Needs At 561 880-0155.

The Village will mail the North Palm Beach Business Tax Receipt to the business shortly thereafter including the approved Palm Beach County application You may then go to the. PO Box 2029. Palm Beach FL 33480.

Complete the Business Tax Receipt form which can be obtained at the Tax Collectors Office or in the Zoning Division lobby located the second floor at 2300 North Jog Road West Palm. 360 South County Road. Subject to regulations of zoning health and any other lawful authority Section 17-17 of Palm Beach County Ordinance No.

Complete the Local Business Tax Receipt Application. For more information about PBC Business Tax Receipts call the Palm Beach County Tax Collectors Office at 561-355-2264. For more information call 561 355-2264 or visit our.

A COU carries a 50 fee for the first year but is just 20 to renew every year after. Renewal notices are delivered to valid Business Tax Receipt. If this is NOT correct.

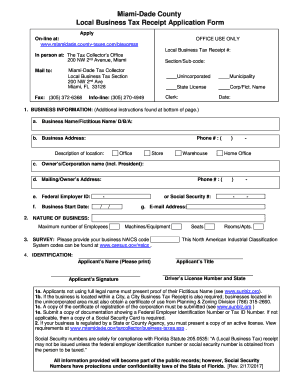

El Portal Area Miami Dade County Local Business Tax Receipt 305 300 0364

Palm Beach County Constitutional Tax Collector Business Tax

Business Tax Rental Tax Receipt West Palm Beach Fl

Business Tax Receipt How To Obtain One In 2022

Community Covid 19 Updates Riviera Beach Florida Fl

The Official Site Of The Manatee County Tax Collector Welcome

Boynton Beach City Library Bbcitylibrary Twitter

Palm Beach County Tax Collector Anne M Gannon S Annual Report 2020 21 By Anne M Gannon Constitutional Tax Collector Serving Palm Beach County Issuu

Free Vaccines Covid And Smallpox Monkeypox News City Of Weston Fl

Business Tax Receipts Monroe County Tax Collector

Business Tax Renewal Instructions Los Angeles Office Of Finance

Constitutional Tax Collector Serving Palm Beach County Facebook

Licensing Insurance Stokes Marine

Tax Collector Offices To Open For Driver License Id Card Services By Appointment Only

Judge Grants Trump Bid For Special Master In Document Search Ap News

Awards Recognitions West Palm Beach Fl

Home Citrus County Tax Collector